Operating a business in the District of Columbia requires adherence to the District’s tax and revenue regulations, including obtaining a Certificate of Clean Hands. This certificate is essential for obtaining a business license, grants, contracts, or other goods and services from the District of Columbia. It serves as proof of your compliance with the District’s financial obligations.

How to Obtain Your Certificate of Clean Hands

The process to verify your Clean Hands status and obtain your certificate remains straightforward and can be completed online at MyTax.DC.gov. Here’s how you can easily obtain your Certificate of Clean Hands in just three simple steps. Visit MyTax.DC.gov: Log in or create an account if you don’t have one.

For non-DC residents, the process is equally simple:

Checklist for Businesses Operating in the District

To ensure your business is in compliance, here are some key points to check:

Remember, all businesses are required to file Personal Property Tax returns unless they are exempt entities (this only applies to businesses located in the District).

What’s New: Reason Codes for Denials

We are excited to announce significant improvements to the process of obtaining a Certificate of Clean Hands. To enhance transparency and assist businesses in addressing any issues, reason codes will now be added to any denials. This means that if a denial is generated, customers will receive specific information about why the denial occurred and who they can contact to remediate any problems. This update is aimed at making the process more user-friendly and helping businesses quickly resolve any compliance issues.

Now when a taxpayer submits an online request for a Certificate of Clean Hands, they will either receive their certificate instantly or—if they are non-compliant—they will receive a clear explanation for a denial. Note that the non-compliance reasons will only display in the online system and will not print out on the notice that is generated to print.

For more details on how to get your Clean Hands Certificate and ensure your business is in full compliance, visit MyTax.DC.gov. It’s easier, faster, and safer to manage your tax obligations online.

Want More Information?

On February 28, Deputy Chief Financial Officer of the DC Office of Tax and Revenue Keith J. Richardson convened the inaugural meeting of the newly formed OTR Tax Advisory Board. This meeting allowed for introductions and lively discussions between board members and our senior staff. It also gave us all the opportunity to start outlining the direction that board meetings will take going forward.

The OTR Tax Advisory Board is part of our agency’s ongoing effort to enhance our public communication and improve our tax administration. This important initiative provides a new forum for our agency to communicate with a broad cross section of tax professionals representing a variety of taxpayers across our community. It is also a venue for us to hear from board members about how we can better serve District taxpayers.

A total of 20 professionals were invited to join the initiative, all of whom brought a great deal of enthusiasm to this initial meeting. Board members come from community tax organizations and nonprofits, tax law firms, academia, and accounting firms, and are excited to provide their expert guidance on ways we can improve our policies and procedures.

The OTR Tax Advisory Board is just one of the ways our agency is working to connect with our community and make it easier for them to manage and understand their taxes. We are dedicated to learning from this dialogue, and look forward to continued discussions with our board members.

For businesses and individuals in the District of Columbia, understanding the DC Personal Property Tax is crucial for compliance and financial planning. This guide aims to demystify the key aspects of this tax, providing answers to some of the most common questions.

The DC Personal Property Tax is a tax levied by the District of Columbia on the possession and use of personal property within its jurisdiction, but does not include real property (land and buildings) or inventory that is sold to customers. Personal property refers to movable assets owned by businesses, such as equipment, furniture, and machinery used in the business.

Generally, every individual, corporation, partnership, executor, administrator, guardian, receiver, trustee, or other taxpayer that owns or holds personal property for a trade or business must file a personal property tax return unless they are exempt from filing.

If the current value of the total personal property reported is $225,000 or less, no tax will be due. However, a return must still be filed even if there is no tax due.

The DC Personal Property Tax return is due annually on July 31st. If July 31st falls on a weekend or a public holiday, the due date is extended to the next business day. The filing deadline is critical for all businesses operating within the District that own taxable personal property. Filing the return on time helps avoid penalties and interest that can accrue on late submissions.

Note that the return is due on July 31st of the tax year being reported. So, for tax year 2024, the return is due on July 31, 2024.

For DC Personal Property Tax, personal property includes all movable assets that are used in conducting business. This includes, but is not limited to:

It’s important to note that inventory held for sale to customers in the ordinary course of business is generally exempt from personal property tax in the District. However, tangible personal property that is leased is included.

Yes, even if your business’s personal property is valued below the $225,000 threshold, you are still required to file a DC Personal Property Tax return. The District of Columbia uses these filings to assess and update its records on the personal property owned by businesses operating within its borders. Filing is mandatory, regardless of whether tax is owed on the property.

Failing to file a DC Personal Property Tax return when a balance is due can result in penalties and interest charges and/or an audit. In an audit, the District may estimate the value of your personal property and assess taxes based on this estimation. This could potentially lead to a higher tax liability than if an accurate return had been filed. Furthermore, continuous noncompliance can lead to more severe legal and financial consequences, impacting your business operations in the District.

Even if no tax is due, failing to file a Personal Property Tax Return is considered tax noncompliance and will result in a business being ineligible for a Certificate of Clean Hands.

You can file a Personal Property Tax return (Form FP-31) by logging on to your MyTax.DC.gov account. Filing electronically is free and secure.

Written by:

Elena Aceves Fowlkes

Assistant Director of Operations

DC Office of Tax and Revenue

Vacant properties—properties that are not actively generating income or serving as primary residences—are a common sight in urban areas. Whether they’re awaiting redevelopment, stuck in legal disputes, or simply neglected, these vacant properties have specific tax implications that property owners and investors must understand.

The Tax Classification Process

In Washington DC, the tax classification of a property plays a pivotal role in determining the amount of tax an owner must pay. Properties are categorized into different groups, each with its own tax rate(s). Vacant properties are defined by statute and must be registered with the Department of Buildings (DOB), which is responsible for the inspection and registration of vacant properties. In addition, DOB may issue exemptions in certain circumstances. Once a property has been registered with DOB, the department will transmit information regarding the property classification to the DC Office of Tax and Revenue (OTR) for the correct tax rate to be applied.

Class 3 Tax Classification

By law, vacant properties are considered threats to health and safety. For vacant properties, the key tax classification to be aware of is the “Class 3” classification. Class 3 is the tax classification that is assigned to vacant properties in the District of Columbia, and it applies to properties that are unoccupied and meet the vacant property conditions defined in District law.

The consequences of a vacant tax classification include a significantly higher real property tax rate.

| Class | Tax Rate per $100 | Description |

| 1 | $0.85 | Residential real property, including multifamily |

| 2 | $1.65 | Commercial and industrial real property, including hotels and motels, if assessed value is not greater than $5 million |

| 2 | $1.77 | Commercial and industrial real property, including hotels and motels, if assessed value is greater than $5 million but not greater than $10 million |

| 2 | $1.89 | Commercial and industrial real property, including hotels and motels, if assessed value is greater than $10 million |

| 3 | $5.00 | Vacant real property |

| 4 | $10.00 | Blighted real property |

Resolving Tax Classification Issues

If a property that was designated as vacant becomes legally occupied, the classification can be updated by DOB once the owner provides DOB the required information. DOB sends updates to the Office of Tax and Revenue daily, and OTR updates its tax database within 48 hours once it receives the information from DOB. DOB has multiple online tools that allow owners to register vacant buildings, verify that buildings are occupied, report a vacant property, or request exemptions for vacant properties. Owners with questions about their vacant or blighted tax classification rates should first contact DOB to address any issues and allow DOB to review and request a classification change to OTR. Owners can always verify their tax classification by viewing their real property tax assessment on MyTax.DC.gov, where their Tax Class is listed.

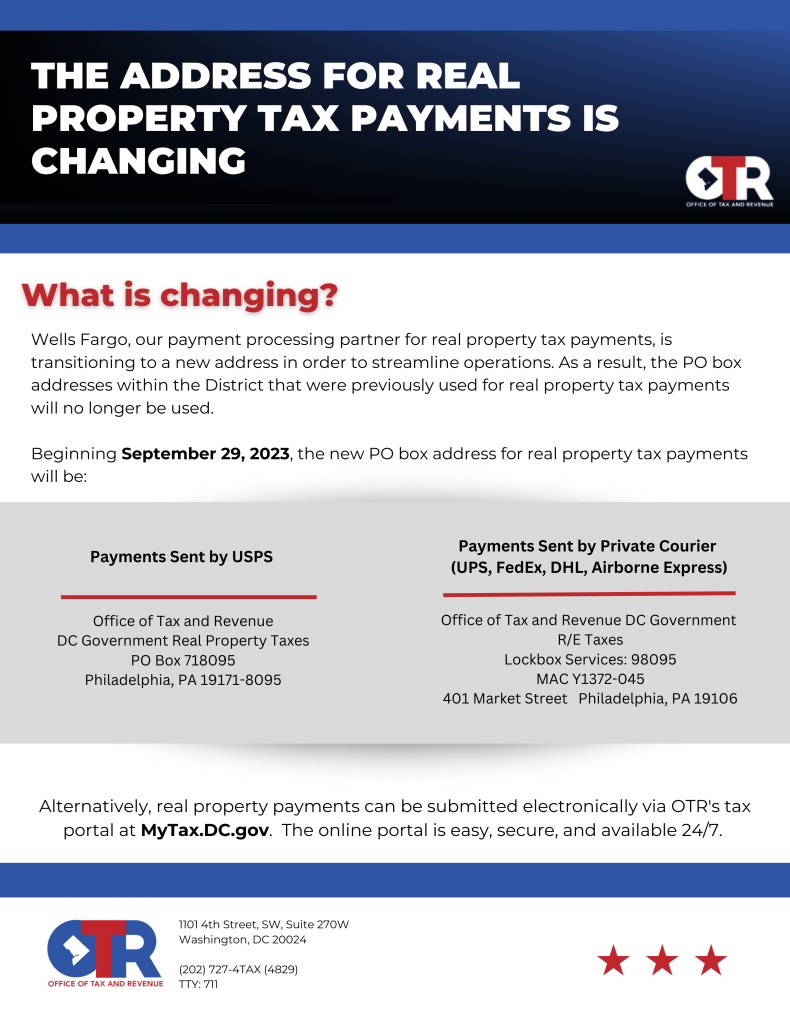

If you’ve been mailing your payments to our Washington, DC address, please note there’s been a change. Wells Fargo, our trusted payment processor, has recently transitioned their processing to “hubs,” and our new mailing address for payments is now based in Philadelphia, PA. This decision was made by Wells Fargo to streamline and centralize their operations.

But remember, if you love the convenience of online payments, nothing’s changed there! You can continue to make your payments seamlessly via our online portal at MyTax.DC.gov. Thank you for updating your records, and we appreciate your understanding and continued trust.

Initiative 82, passed by District voters in November 2022, eliminated the tipped minimum wage for servers, bartenders and other tipped workers which was $5.35. (See, Initiative Measure No. 82 – District of Columbia Tip Credit Elimination Act of 2021, D.C. Law 24-0281). To reach the DC minimum wage, currently $16.10, the minimum wage difference was made up with gratuities, whether voluntarily given by consumers or required to be paid by consumers. This gratuity is otherwise known as the “tip credit.” Beginning on May 1, 2023, employers are required to supplement workers’ pay if the worker did not earn enough in tips to reach the DC minimum wage. The tipped minimum wage will be phased out by 2027 to be replaced with one universal minimum wage.

As businesses begin to comply with Initiative 82, OTR has received several inquiries from consumers who have recently noticed an additional line-item mandatory charge on their bills from establishments such as restaurants, food establishments, liquor stores, hotels, and other retailers. These charges may be characterized as a “fair wage service charge,” “packaging fee,” “resort fee” or other similar description, and are added to the total amount of the sales price of the transaction.

OTR reminds businesses and consumers that, under District law, if the tangible personal property or taxable service being sold is subject to District sales tax, the business must collect and remit a sales tax on the total sales price. See, D.C. Code § 47-2001(g-3) and § 47-2001(p)(1). Therefore, if a business adds a mandatory service charge, fee or other similar item to the total sales price, District sales tax is due on the total sales price including the mandatory service charge or fee.

For additional information regarding the taxability of these mandatory charges, please contact OTR’s Customer Service Center at (202) 727-4TAX (4829). If you have questions about whether such charges are legal in the District, please contact the Office of Attorney General, Office of Consumer Protection at www.oag.dc.gov/consumer-protection or (202) 442-9828.

Beginning Tuesday, March 7, from noon – 12:30 p.m., the Office of Tax and Revenue’s staff will host a series of interactive discussions on topics such as the DC Earned Income Tax Credit (EITC), the clean hands process, and much more.

Each Tuesday, participants will learn more about the following topics:

The live stream will begin promptly at noon on OTR’s official Instagram page, @MyTaxDC. We look forward to your participation.